Table of Contents

Introduction

When I was a new investor, I made it my goal to understand what various financial ratios meant because I knew that each ratio provided me with essential information about a company that I was looking to invest in.

This article will provide value to both the new investor who has not experienced analyzing financial ratios and to the experienced investor who seeks more information about each of these four instrumental profitability ratios detailed in the post.

The primary objective of this article is to have you build a strong comprehension of these four ratios so that you can begin applying this knowledge when comparing companies and making your investment decisions that way you end up with a better return on your investment.

Note that each one of these four ratios is a profitability ratio. When profitability is mentioned that means that we are focusing on the income statement where our revenues and expenses are detailed instead of the balance sheet or statement of cash flows.

Gross Profit Margin

Calculating the Gross Profit Margin

The gross profit margin formula is presented below:

Gross Profit Margin = (Net Sales – Cost of Goods Sold (COGS)) / (Net Sales)

It is important to note that the sales in this formula are net sales not gross sales. Gross sales would be our total revenues. Net sales is our Gross sales subtracted by sales allowances, returns, and discounts.

Net Sales = (Gross sales – allowances – returns – discounts)

COGS represents the direct costs of producing a product by an organization. It includes any direct labor and materials cost that went into creating the product. Indirect costs are not included within COGS. COGS is also synonymous with cost of sales.

Indirect costs encompass costs that are not directly related to the development of a company’s product or service.

Some examples of direct costs:

- Equipment used in making the product

- Labor costs associated with making the product

- Raw materials used to make the product

- Manufacturing supplies that went into creating the product

Examples of indirect costs:

- Utilities

- Office supplies

- Marketing costs

- Accounting and payroll costs

- Insurance costs

- Office technology

- Employee benefit costs

Cost of Goods Sold (COGS) is calculated the following way:

COGS = Beginning inventory + Purchases during the period – Ending inventory

Significance of the Gross Profit Margin

The gross profit margin is a profitability ratio that is relevant for investors and creditors because it displays the company’s ability to grow their revenue or sales and how effective they are at managing costs.

Businesses can improve this ratio by focusing more on products that sell well and are more profitable and focusing less or eliminating products that underperform relative to their other products.

Products that do not sell well can also be revived through quality and pricing improvements to bring them more in line with your more profitable offerings.

Another strategy the company could utilize is to improve their production processes by investing in better equipment that will use less materials and produce the product quicker.

The way space is utilized, how the machinery is setup on the floor, and how skilled the employees are will also reduce direct costs and elevate the gross profit margin of the company (different efficiency measures across various industries).

Outside of teaching employees new skills, good company culture, strong leadership, bonuses, sales targets, and other incentives will also enhance these profitability ratios as employees will become motivated and have a greater purpose to make more sales or work more efficiently.

Lenders/creditors will take a look at your profitability ratios (all of them included on this blog post) to see how profitable and efficient your company is, which is an important aspect of whether they decide to provide you with loans or not.

Two of the primary ways companies generate funding for their company outside of sales is through acquiring debt through a creditor or through the sale of stock, which becomes a significant way of financing when the company becomes publicly traded.

Operating Profit Margin

The operating profit margin formula is: (Operating income/Revenue).

Operating income is our gross profit amount minus operating expenses. Operating expenses are costs incurred from normal operating activities and includes but is not limited to:

- Rent

- Payroll

- Equipment

- Inventory

- Marketing

- Insurance

- Depreciation and Amortization

- Research and Development

Operating income is one of the most important types of income presented on the income statement to both investors and creditors. This figure displays how efficient the business is being run and how well they are controlling their operating costs, which are the primary costs of running a business.

Operating income is also a critical amount as it does not include taxes and other unordinary expenses that may be included in other income, non-operating income and nonoperating expenses that have the potential to skew a company’s profit in a given year.

If our operating income was 20 million and our total revenues for the quarter was 100 million, our operating profit margin would be 20/100 or 20%. This means that for every $1.00 of revenues we earn $0.20 of operating income.

Other companies who wish to acquire another business may examine the operating profit margin of the business they are looking to acquire to get an idea of how efficient the company is relative to their peers in the sector or industry.

Additionally, they would be strategizing ways to improve the business they are looking to acquire to minimize operating expenses and to become an industry leader.

Being a more efficient business in your industry will not only provide greater financing from investors but from creditors when seeking debt to accelerate growth.

Management has much more influence over variable costs such as payroll, raw materials, production supplies and freight out. Since this is the case, the operating profit margin is the best indicator of the strength of the company’s management team when compared to the other profit margin ratios detailed in this post.

For the investors out there, please note that operating income is slightly different than earnings before interest and taxes (EBIT). EBIT includes non-operating expenses and income as well as other income while operating income does not. EBITDA excludes non-cash expenses, which are depreciation and amortization.

Pre-tax Profit Margin

The pre-tax profit margin is similar to EBIT explained above except that it excludes taxes, so it is earnings before taxes (EBT). The formula is equal to:

Pre-tax margin = (earnings before taxes / total revenues).

In my view, the pre-tax margin formula is valuable but not as valuable as our operating profit margin because it does include those non-operating expenses/income and other income which may hinder its comparability to other companies within its industry because of unordinary expenses/income included within the figure.

This formula is a little more valuable than the net income margin because it does exclude tax related expenses. Tax costs do not provide much value in that they do not tell us much about the efficiency of a company.

Each company’s tax situation is different, and this amount does not provide us with an apples-to-apples comparison between two companies, even within the same industry due to the breadth of the tax law and the vast amount of taxable events that can occur within a given year for each individual company.

Net Income Profit Margin

The net income profit margin ratio is: (Net income / Revenues). This ratio is similar to our pre-tax margin except it does include tax costs as net income is our earnings left over after all expenses.

Net income is commonly referred to as the company’s bottom line. This makes sense because it is the last item displayed within an income statement. Top line growth symbolizes growth in sales or revenues before expenses.

Bottom line growth occurs when either revenues increase and expenses stay consistent or when sales remain consistent and expenses are decreased. Top line growth occurs during company expansion and bottom-line growth typically occurs from enhanced efficiency (minimizing expenses).

Apples to Apples Comparisons

This is one of the most important sections in the post and is essential to understand sooner in your investing journey rather than later. These ratios are not comparable across different sectors or industries.

When you would like to compare one company’s profitability ratios to another it is crucial to compare two companies within the same industry. For example, it would not make sense to compare a manufacturer who has a lot of overhead and fixed assets to a company that provides services online to their customers.

The manufacturer will undoubtedly be more leveraged and have lower profitability ratios than the internet service company because of the higher costs for equipment, materials, buildings, etc.

This does not mean that the investor should stay away from the manufacturer and only invest in online service businesses because of the higher profitability ratios.

Diversification/exposure to different industries is integral and is a topic on its own.

Additionally, if the manufacturer is a leader in its industry and is quickly expanding, the share price has the potential to appreciate just as quickly as a great online service business despite having lower profitability ratios because it is not an apples-to-apples comparison.

Even when comparing two companies within the same industry, it is critical to consider factors such as business model, company size, and geography when making the comparisons.

For instance, Company A in industry C makes all their products in house and Company B in industry C outsources their production. Due to this varying cost structure, these two companies may not be the best to compare against each other.

Another great example of lack of comparability are two companies in the same industry with a large difference in their market capitalization. It would not be a fair comparison to compare a company with a 4 billion market cap to a 400 billion market cap company.

These two companies are in different stages of a company life cycle and it would be necessary to put economies of scale principles into the picture as well.

The larger company could prove to be more efficient due to their time in the market and the connections they have built with suppliers/distributors, volume discounts, higher production efficiency on the floor, and cheap outsourced labor.

On the other hand the larger company could be in the mature phase of its company life and have less top line growth than a small cap company that is in growth mode given the law of large numbers. It is much more difficult for the 400 billion company to grow to a 4 trillion market capitalization than it would be for the 4 billion market cap company to grow to 40 billion.

Factoring in geography when making company comparisons is pivotal. The political environment may impact costs and revenues associated with the business as regulations are different in each nation.

Different regions have varying consumption culture, demographics, and demand for products. Company A in North America will operate differently than Company B in the same industry located in Asia given these factors. This adaptation to the region will result in varying costs and revenues, lowering the comparability of these two companies.

Combined Calculation Example of All Margin Formulas

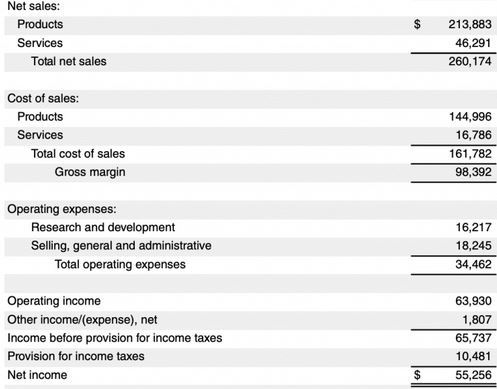

I wanted to provide you with a complete practical example of all of these four profit margin formulas in action by using a real income statement to calculate these figures.

In the image above, we can see that our total revenues or sales is $260,174. Remember that total sales is a common denominator in all four of the ratios.

Gross profit margin: The first step is to calculate our gross profit = (total sales – COGS) = $260,174 – $144,996 – $16,786 = $98,392

Now that we have our gross profit, we take that amount and divide it by total sales to arrive at our gross profit margin: ($98,392 / $260,174) = ~37.82

Operating profit margin: We first take our total sales and subtract our cost of goods sold and our operating expenses to arrive at operating income: ($260,174 – $144,996 – $16,786 – $16,217 – $18,245) = $63,930

With the same process we take our operating income and divide it by total sales to arrive at our operating income profit margin: ($63,930 / $260,174) = ~24.57

Pre-tax profit margin: Now that you get the idea, instead of going line item by line item we can use the totals of each figure in our pre-tax profit margin formula. Let us begin with calculating our earnings before taxes (EBT):

Total sales – COGS – Operating expenses – other income (expense) = $260,174 – $161,782 – $34,462 + $1,807 = $65,737.

Before we go on to calculating our pre-tax profit margin, notice how the $1,807 is positive. When this company summed their other income and other expenses, their other income was higher than their other expenses, so instead of subtracting an expense we added $1,807 in other income.

Pre-tax profit margin = ($65,737 / $260,174) = ~25.27

Net profit margin: Recall that the only difference between this formula and the pre-tax profit margin is that we include and subtract tax expense.

Total sales – COGS – Operating expenses – other income (expense) – taxes = $260,174 – $161,782 – $34,462 + $1,807 + $10,481 = $55,256

Net profit margin = ($55,256 / $260,174) = ~21.24

In summary, for every $1.00 in revenue/sales that this company generates, they earn 37.82 cents in gross profit, 24.57 cents in operating profit, 25.27 cents in pre-tax profit, and 21.24 cents in net profit.

Conclusion

The common thread amongst these four profitability ratios is that they show us how efficiently a company is run and how well they manage various expenses.

The pre-tax profit margin and the net profit margin are valuable but be cautious as there may be unordinary or one-time expenses included within them that may make them less reliable than the gross profit margin and the operating profit margin.

As mentioned earlier, the most valuable ratio out of the four is the operating profit margin because it displays how efficiently management is managing their core day-to-day operations/business expenses.

When making company comparisons ensure that the two companies you are comparing are within the same industry and are really apples-to-apples comparisons by thinking about factors like size, cost structure, and location.

Have you had any experience using these ratios and did they help generate a better ROI for you? What are some of your favorite income statement ratios? Please let me know in the comments below.